31 October 2019

Manulife US REIT’s Acquisition Journey: How Acquisition Targets are Sieved, Identified and Secured

REITs that have a strong sponsor benefit from the ability to leverage on the sponsor’s track record, connections, footprint and investment experience. This benefit is clearly seen in the relationship between Manulife US REIT (SGX:BTOU) and its sponsor The Manufacturers Life Insurance Company (Manulife), part of the Manulife Group.

Manulife US Real Estate Investment Trust (MUST) is a Singapore REIT listed on the Singapore Exchange (SGX) since 20 May 2016. Its investment strategy is principally to invest, directly or indirectly, in a portfolio of income-producing office real estate in key markets in the US, as well as real estate-related assets.

MUST is managed by Manulife US Real Estate Management Pte Ltd (REIT manager) which is wholly owned subsidiary of the Sponsor, Manulife. In this sense, MUST is an internally managed REIT where its sponsor is both a significant shareholder in the REIT holding 8.89% interest as at 19 September 2019 and directly involved in the management.

One key benefit of such a structure is the alignment of interest between the manager and a unitholder of the REIT. But another less evident but no-doubt significant benefit is direct access to Manulife Investment Management's team of real estate professionals. One key component of the team is the acquisitions team which is actively on the ground seeking out investment opportunities for the entire Manulife Group including MUST.

Introduction to the Acquisitions Team

Manulife’s Global Real Estate Team headquartered in Toronto and the acquisitions team focused on the US comprise approximately a dozen acquisitions professionals who are based out of Boston, New York, Toronto and Los Angeles (LA). The team is a shared service assisting the various Manulife asset management entities acquire high quality assets that are complimentary to their investment objectives and mandate – amongst them MUST and Manulife’s General Accounts (GA).

Manulife Real Estate team has established ten regional branches all over the US and the acquisitions team is constantly traveling to stay in touch with real estate owners, intermediaries, and brokers such as JLL, Cushman & Wakefield and CBRE. This enables the team a comprehensive coverage of all the gateway and key real estate markets.

Besides working with brokers, being on the ground and staying in touch with other asset managers enables the team to also obtain information on off-market assets. This had the added advantage of gaining access to an acquisition opportunity before it may be brought to the market. For example, Plaza (500 Plaza Drive, Secaucus, New Jersey) was purchased in an off-market situation directly from a large financial institution together with a real estate operating partner because of the team’s strong relationships with other asset managers.

Due to the complex nature of financing and transacting commercial office buildings, sellers seek out reliable buyers whom they are confident in to see an acquisition to completion. The Manulife acquisition team’s strong track record in completing transactions throughout various market cycles also provides strong credibility among brokers and asset owners. This results in the acquisition team typically being among the first groups to be contacted when an asset owner intends to sell their assets.

For example, the team continues to observe strong growth drivers for commercial real estate which are situated near established educational institutions such as universities. In our current era of digital disruption, there is a significant shift in the nature of work. Employees with high level of education, skills and creativity are increasingly in demand. A good example is the city of Atlanta where employers have been setting up offices to draw from a strong talent pool from Georgia Institute of Technology (Georgia Tech). Therefore, the acquisition team has been on the ground sourcing for high quality real estate to acquire in Atlanta.

Discoveries and opportunities are presented at least once every fortnight (sometimes weekly) at Manulife’s regular pipeline meetings. This maintains a constant flow of information from ground up. As each portfolio manager currently has different objectives for their funds, there is minimal competition within the group for the same assets. For example, MUST seeks out stable and mature assets which are yield enhancing. On the other hand, other managers’ mandates generally seek targeted Core Plus assets for light asset enhancement, efficiency improvements and/or tenant optimisation. Further, Manulife practices a rotational rights-of-first-refusal (ROFR) allocation, giving all portfolio managers a fair chance at each presented opportunity.

Increasingly Competitive Landscape

The current acquisition landscape for good quality US commercial offices is increasingly becoming crowded and competitive. There are more players vying for the same assets. In the past, where there would be 3 to 5 bidders when an asset comes to market, now brokers are observing anywhere from 5 to 8 bidders, depending on the market.

In the past, while bidders for US commercial real estate included asset managers and real estate funds, today brokers are noticing increasing participation of individual retirement plans, pension funds, high-net-worth individuals (HNWI), family offices, REITs and foreign Sovereign Wealth Funds. A report from PwC estimates that the international stock of institutional investment grade real estate will expand by more than 55% from US$29.0 trillion in 2012, to US$45.3 trillion in 2020. They project this to grow further to US$69.0 trillion in 2030. The data shows that international institutional competition in real estate is simply intensifying.

Securing government approval for commercial real estate development in US generally takes much longer compared to residential depending on zoning. As a result, developers tend to favour building of new condominiums and apartments instead, resulting in limited supply of existing commercial assets. When a proposal is submitted for the development of commercial real estate, impact analysis is commissioned ahead of the approvals. These may include environmental impact of the development, consideration of noise levels, implications on traffic flow and congestion, and overall compatibility with the surrounding areas. The approval process could even drag on for up to 3 years especially when stakeholders in the vicinity file objections to the proposal. Approvals for residential proposals on the other hand could be as fast as a year, depending on zoning and political will.

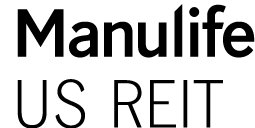

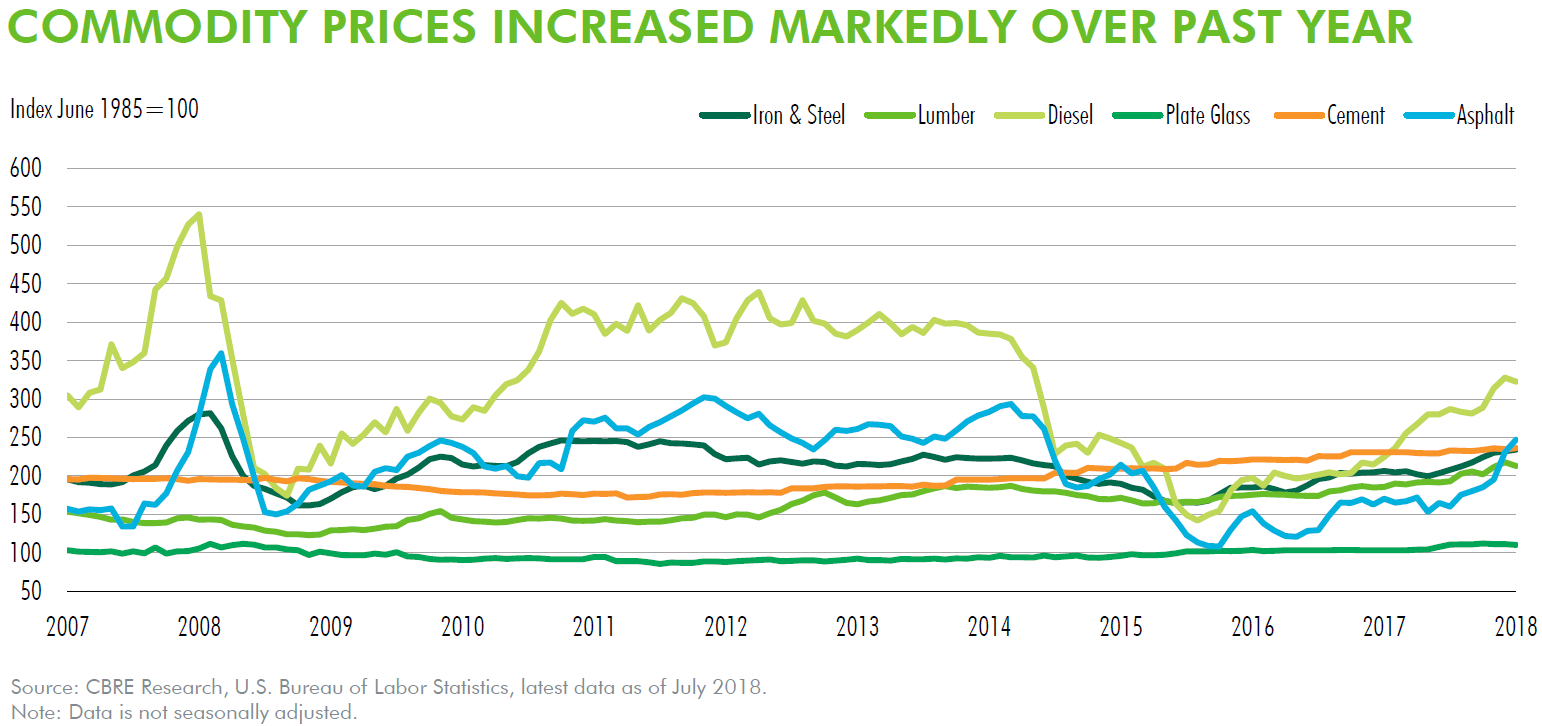

Besides approvals, another reason for the competitive bidding in the US commercial sector is the high replacement cost. Replacement cost is the fully loaded cost to source the raw materials, labour and land to rebuild a comparable office asset. Among the forces driving up the replacement cost in US commercial real estate are increasing labour cost and the spike in construction related commodities such as diesel, asphalt, lumber, iron and steel. As a result, in several US markets, not only is purchasing an existing building cheaper, it is also faster than constructing a new one and market forces can pivot more bidders for the existing asset.

The confluence of high replacement cost, long approval process and increasing institutional participation continues to drive up demand for existing US commercial real estate assets in gateway cities. Therefore, REITs that have a strong sponsor’s backing, past track record, in-depth local knowledge, established connections, and strong financial standing have the capability to submit more competitive bids and get ahead of the competition.

With a strong relationship with the Manulife Group, the REIT manager has access to the full suite of services from the Manulife acquisitions team, allowing them to gain a competitive edge during the acquisition process.

The Acquisition Process

Leading on from the fortnightly pipeline meetings, the acquisition process formally begins. The acquisition process can broadly be broken down into the following phases:

- 1.Assessment

- 3.Due Diligence

- 2.Bidding

- 4.Closing

Source: Manulife US REIT FY2018 Annual Report

Assessment

Once an acquisition target is allocated to MUST through a formal process, both the acquisition team and the REIT manager will perform an assessment of the asset.

During this phase, the seller or broker will provide the projected cash flow, economic analysis of the submarket and other relevant data regarding the asset for the consideration of the potential buyer.

Forecasts of future cash flows within these models are usually loaded with assumptions and therefore must be adequately analysed. With the projection data in hand, the team will review the assumptions behind the projections to get a sense of the fair valuation of the asset. The absence of such a review may invariably result in an over- or under-estimation of the asset value.

As the brokers are a natural beneficiary of the transaction, they tend to paint an optimistic picture of the asset. As a prudent purchaser, Manulife would seek the advice and opinions of other independent brokers. Advice also includes research data on the submarkets to ensure the macro-economic fundamentals are supportive of the asset’s future potential. These could include research on population growth, demand and supply statistics, peer transactions, talent pool, and accessibility of the asset amongst the many other considerations.

Further to these assessments, the REIT manager will also assess the pro forma effects of the acquisition in terms of the DPU, NAV per Unit, gearing, lease expiry profile, WALE, sector and geographic diversification, occupancy, presence of any single tenant risk, and fit with its existing portfolio.

In short, this assessment helps the team understand if the acquisition is suitable and fits the investment objective of the respective fund.

After the assessment, a bid is placed. Typically, the seller will review these first-round bids and shortlist about 3 to 5 potential bidders and move on to the next phase of the acquisition journey.

The shortlisting of the potential bidders isn’t simply picking out those with the highest bids. There are a wide range of factors such as the past track record of the buyer, reliability of completion, ability to secure financing, and understanding of the tenants and markets. This is where Manulife as a group excels with its strong track record of asset management and investment management expertise with North American real estate as well as close relationships with its panel of bankers.

Second round bids occur (sometimes 3 rounds) before the buyer is selected.

Due Diligence

An experienced bidder would have primed their due diligence professionals ahead of time to aid in the full assessment of the asset. This is crucial as a bidder only has this limited period to decide. Once the due diligence period expires, the monetary deposits become non-refundable.

The due diligence phase refers to the time allotted to the buyer to inspect the property and decide if they want to proceed with the transaction.

Due diligence work includes commissioning site surveys and environmental reports, investigation of historical land use, structural integrity inspections, title searches, as well as gathering of all documents related to the asset and reviewing of all existing tenancy contracts. Land transfer taxes are determined during the due diligence phase.

Valuers will also be appointed during this stage to provide independent appraisal of the asset.

When the full due diligence report is ready, it will be presented to the investor committee, along with the identification of risks. A risk assessment is taken to decide whether to proceed with the acquisition or if any special terms or conditions need to be supplemented into the contracts. As an example, MUST was in advanced stages of acquiring a potential asset in Stanford, Connecticut. However, the due diligence process had detected toxicity on the grounds that the building was constructed. It turned out that the building was sitting on a previously demolished industrial complex where the toxins originated. Thanks to the Manulife Group’s stringent and thorough due diligence process, it had protected MUST’s unitholders from unnecessary risk associated with that asset.

Only if the REIT manager and investment committee are thoroughly satisfied will they make the decision to proceed with the transaction – after which a final bid will be placed.

Due diligence is conducted from a legal standpoint to ensure all terms and conditions between the buyer and seller have been met and there are no further legal claims or liens found on the property.

A property lien is a legal claim on assets which allows the holder to obtain access to property if there are outstanding debts. Typically, if liens are identified, the buyer may demand that the seller settle any debts before the completion of the sale.

Specifically, for a REIT, if the property is acquired directly from the sponsor, it would be considered an Interested Party Transaction (IPT). For IPTs, the transaction is subjected to unitholder approval at an Extraordinary General Meeting (EGM) and there is a clause for the REIT not to complete the acquisition should the REIT manager fail to obtain the necessary unitholder approvals.

Closing

When the buyer is fully satisfied with their due diligence review, the due diligence is waived. For IPTs, this would happen only after receiving the unitholder approvals during the EGM.

When the due diligence is waived, this process is said to be “going hard” which means that the buyer is going ahead with the transaction. The deposit monies are now non-refundable, and the seller will complete estoppels and begin transferring the legal title of the asset to the buyer on the closing date. Purchase consideration occurs on the closing date.

Summary

The real estate acquisition landscape is becoming competitive due to increasing capital flows by international institutional participation. To remain competitive, REITs that have strong sponsor support are able to competitively navigate and secure high-quality assets to fuel their growth.

A strong sponsor would be able to provide the REIT access to a team of experienced real estate professionals with established relationships with asset managers, real estate owners and brokers. The ability to secure financing and execute efficiently on a deal will earn the team strong credentials within the industry, perpetuating a virtuous cycle of growth for the REIT.

Throughout MUST’s last six asset acquisitions, the Manulife acquisitions team played a crucial role in securing these high-quality assets. This highlights the importance of a strong sponsor who is able to provide continuous support to the REIT. Going forward, they are the unsung heroes that will continue to play a critical role behind the scenes to propel MUST’s future growth trajectory for the benefit of unitholders.

This article first appeared on ProButterfly.com.