Team

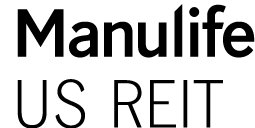

Board of Directors

The Manager, Manulife US Real Estate Management Pte. Ltd., was incorporated in Singapore under the Companies Act on 2 February 2015.

The Manager is indirectly wholly-owned by the Sponsor. The Manager has general powers of management over the assets of Manulife US REIT. The Manager's main responsibility is to manage Manulife US REIT's assets and liabilities for the benefit of Unitholders.

The Manager sets the strategic direction of Manulife US REIT and gives recommendations to the Trustee on the acquisition, divestment, development and/or enhancement of assets of Manulife US REIT in accordance with its stated investment strategy.

To the extent activities of the Manager, including under the investment advisory and asset management agreement, would otherwise be required to be performed within the United States (and are not otherwise to be performed by the U.S. Asset Manager), those activities will be delegated to S-REIT Manager US Corp., a wholly-owned subsidiary of the Manager incorporated in the United States.

The Manager holds a Capital Markets Services licence issued by the Monetary Authority of Singapore pursuant to the Securities and Futures Act.

Mr. Marc Feliciano

Chairman, Non-Executive Director and Nominating and Remuneration Committee Member

Mr. Feliciano is the Global Head of Real Estate, Private Markets at Manulife Investment Management. In his role, Mr. Feliciano is responsible for developing and implementing the strategy and increasing the firm’s capabilities in this area on behalf of clients, including Manulife’s General Account. This includes overseeing all aspects of the real estate business, including portfolio management, investments, asset management, development of new products and the integration of sustainability into both investments and operations.

Prior to joining Manulife, Mr. Feliciano was the Chief Investment Officer (CIO) of Real Estate, Americas, and the Head of Portfolio and Asset Management for the RREEF Real Estate Americas business. He was also Head of the Americas Debt Investments Group. Mr. Feliciano was also a member of the Americas Leadership Committee and Global Investment Committee. He served as Chairman of the Americas Real Estate Investment Committee, which governs both equity and debt investments and portfolios, and serves on the Americas Real Estate Management Committee. As Americas CIO, he worked with portfolio managers in developing specific portfolio strategy for each account or fund as part of the annual investment plan process.

He also was a board member of RREEF Property Trust, a non-traded REIT. Prior to assuming this position, he served as Global Head of Risk and Performance Analysis, responsible for the development of allocation, risk and performance tools. In this role, he was a member of the Global CIO Group working closely with the Global and regional CIOs, and the research team to formulate the global and regional house views and strategy, and to develop the resulting House Portfolio for each region. While with RREEF Real Estate, he led debt restructurings across several accounts and funds in conjunction with the Americas portfolio management, asset management and capital markets teams. Mr. Feliciano also worked in the private and public real estate industries while at Morgan Stanley, Heitman/PRA Securities Advisors and INVESCO Realty Advisors.

He received undergraduate and graduate degrees in accounting with a concentration in finance from the University of Texas at Austin

Professor Francis Koh Cher Chiew

Independent Non-Executive Director, Lead Independent Director, Audit and Risk Committee Member and Nominating and Remuneration Committee Member

Professor Francis Koh is Emeritus Professor of Finance (Practice) in the Lee Kong Chian School of Business, at the Singapore Management University (SMU). From 2002 to 2020, he taught at SMU, where he held various academic and administrative appointment. He was the Founding Director of the MSc in Wealth Management Programme at SMU from 2004 to 2019, Vice-Provost (Special Projects) from 2012 to 2017 and Inaugural Mapletree Professor of Real Estate from 2017 to 2019. From July 2017 to June 2020, he was also appointed Special Advisor, Office of the President, to oversee the Office of Investments, which manages the university’s endowment funds.

Prior to joining SMU in 2002, he was a tenured faculty at the National University of Singapore (NUS). While at NUS, he held several administrative positions, including Vice-Dean, Faculty of Business Administration and Director, Financial Management Program for Executives.

Between 1994 and 2002, Professor Koh was employed by the Government of Singapore Investment Corporation (GIC). He was involved in private equity investment projects in various countries in the region, including China, Thailand, Indonesia, and Malaysia. He was also involved in many corporate training and development initiatives at GIC.

Professor Koh has also been active in corporate consulting, executive development and public service. He is an Independent Non-Executive Director of China Taiping Insurance Pte Ltd in Singapore, and was a Member of the Board of Governors at the Singapore College of Insurance. He was appointed by Monetary Authority of Singapore (MAS) to the Financial Advisers Industry Review (FAIR) Panel in 2012 and by the Ministry of Law to the Advisory Panel on Money Lending in 2014. Organizations he had consulted for include Bank of Singapore, Citibank, GIC, IBM, IBF, Monetary Authority of Singapore, IMAS, Maybank, OCBC Bank, Singapore Airlines and Standard Chartered Bank.

He has published in numerous academic journals. His academic articles have appeared in the Journal of Financial Economics, Journal of Business Finance & Accounting, Journal of Business Venturing, Asia-Pacific Journal of Management and Singapore Economic Review. He has written book chapters and presented papers at international conferences, including meetings of the American Finance Association, Asia-Pacific Finance Association and Academy of International Business.

In 2012, Professor Koh was awarded an Honorary Doctorate (honoris causa) in Economics by the University of St Gallen, Switzerland. In 2013, he was conferred the Public Administration Medal (Silver) Award by the Singapore Government. In 2015, he received a special award for 20 years of service from the Ministry of Education. In 2016, he received the Lifetime Achievement Award from WealthBriefingAsia for his contributions to the wealth management industry. In 2020, he received the Distinguished Educator Award from SMU.

Professor Koh obtained the degree of BBA (Hons) from the University of Singapore, MBA from the University of British Columbia, and Ph.D from University of New South Wales. He is a member of the Institute of Chartered Public Accountant of Singapore and a Fellow of the Chartered Institute of Management Accountants (UK).

Ms. Veronica McCann

Independent Non-Executive Director and Audit and Risk Committee Chairman

Ms. McCann is a senior financial executive with over twenty three years' experience in the finance sector of the Asia Pacific Region.

Having a track record of leading organisational change and managing complex financial and regulatory risks during periods of rapid expansion and restructuring, Ms. McCann was CFO Asia and Deputy Chief Executive, Singapore up to 2015 at Commerzbank AG, the second largest credit institution in Germany and one of Europe's major banks. She started with Commerzbank in 2006 where she was mandated to build and develop strong independent Finance, HR and Legal/Compliance functions. Ms. McCann then transitioned to the Head of Finance & HR for Asia Pacific in 2008 and transitioned to the CFO role in 2009.

Prior to joining Commerzbank, Ms. McCann was at Canadian Imperial Bank of Commerce ("CIBC") in various roles from 1989 to 2006, including Head of Management Accounting, Europe. In 1992 Ms. McCann transferred to the CIBC Singapore office where she successfully led the finance function and obtained the CFO Asia appointment in 1993. In 1994 she was appointed Deputy Chief Executive of Singapore Branch. Between 1997 and 1998 she led the regional cross functional team to resize the Asia region.Ms. McCann commenced her career in the financial services sector with UBAF UK as an Assistant Chief Accountant.

Ms. McCann is a Fellow of the Institute of Management Accountants, a member of the Chartered Global Management Accountants and a Member of the Singapore Institute of Directors. She also served as the Treasurer of the British Chamber of Commerce Singapore from 2015 to 2018.

Dr. Choo Kian Koon

Independent Non-Executive Director and Nominating and Remuneration Committee Chairman

Dr. Choo has over 35 years of experience in the real estate industry including research, consulting, valuation, property management, leasing, development planning and investment appraisal in both the private and public sectors. His contributions to Singapore's urban development and real estate market over the years include being on the inaugural International Advisory Panel (IAP) for the development of the cutting edge one north project at Buona Vista, and serving as the Deputy Chairman of the Land Working Group of the Economic Review Committee (ERC) which sanctioned the creation of REITs and development of the New Downtown and Marina Bay Financial Centre. He has also served on the boards of JTC Corporation under the Ministry of Trade and Industry, Singapore Land Authority (SLA) under the Ministry of Law, the Valuation Review Board (VRB) under the Ministry of Finance, and NTUC Choice Homes under the National Trade Union Congress.

Since 2013, Dr. Choo has been the Chairman of VestAsiaGroup, a Singapore-based real estate advisory. He is also an Adjunct Associate Professor at the Department of Real Estate, National University of Singapore (NUS) and serves as an Independent Non-Executive Director on the board of SGX-listed Pan Hong Property Group Limited, a developer operating in China's second and third tier cities. Dr. Choo previously also served as an Independent Non-Executive Director on the board of Ascendas Hospitality Trust, a pan-Asian REIT and business trust active in the hotel and serviced apartment sectors.

Between 2009 and 2011, Dr. Choo served as the first CEO of the Real Estate Developers' Association of Singapore (REDAS) where he created the NUS-REDAS Real Estate Sentiment Index (RESI) for Singapore and established the NUS-REDAS executive courses in real estate development enterprise, and real estate development law. Before that, Dr. Choo was an independent consultant to Surbana Technologies in large-scale overseas township and tourism developments and strategic city management projects, as well as an expert trainer to private bankers in real estate and REITs at the Wealth Management Institute (WMI) of the Temasek Management Services Group.

In early 2002, Dr. Choo was appointed to the CapitaLand Group as its Senior Vice President, Research and Direct Investment, and was in the core team that supervised the successful launch of the first REIT in Singapore – the retail-based CapitaMall Trust (CMT). Apart from serving as a director on CMT's inaugural board, Dr. Choo was also instrumental in the IPO of the Group's second REIT, the office-based CapitaCommercial Trust (CCT), and held various portfolios such as SVP, Corporate Development, and country head, Malaysia.

Prior to joining CapitaLand, between 1995 and 2001, Dr. Choo was a senior partner and the National Director and Head of Research and Consultancy at Jones Lang LaSalle (JLL) Singapore. He was JLL Asia Pacific regional head of research and Global Research Committee member and had advised numerous international financial institutions and institutional investors as well as sovereign wealth funds such as the GIC and Abu Dhabi Investment Authority. Before JLL, Dr. Choo was with Richard Ellis Property Consultants (1993-1995), the School of Building & Estate Management, NUS (1981-1993), and Lands and Estate Division, Ministry of Defence (1979-1981) where he held several senior positions.

A Commonwealth Scholar, Dr. Choo obtained an M.Phil in Environmental Planning from the University of Nottingham (1979) after graduating from the University of Singapore in Estate Management (1974). Dr. Choo holds a Ph.D in Urban Planning from the University of Washington with a Certificate of Achievement in Urban Design (1988) and is a member of the Tau Sigma Delta Honors Society in Architecture and Allied Arts, USA. He is a Fellow of the Singapore Institute of Surveyors and Valuers(SISV) and an Affiliate Member of the Singapore Institute of Planners (SIP).

Mrs. Karen Tay Koh

Independent Non-Executive Director, Audit and Risk Committee Member and Nominating and Remuneration Committee Member

Mrs. Koh is a Board Director with extensive experience in both public and private sectors, who has supervised, led or advised organisations spanning finance, healthcare, education, and private equity. She has expertise in executing business-building entrepreneurial initiatives across companies in various stages in their life cycle, from start-ups to dominant industry incumbents.

Mrs. Koh is an Independent Non-Executive Director at SGX-listed Banyan Tree Holdings, HSBC Bank Singapore Limited, BC Platforms AG and The Red Pencil Singapore. She is a member of the Advisory Board of the Centre for Emerging Markets, D’Amore-Mckim College of Business, Northeastern University US, and was a member of Northeastern’s Corporation from 2011-2018. Mrs. Koh’s past board experience include Falck (Denmark), Singapore Deposit Insurance Corporation, Singapore Economic Development Board Investments Pte Ltd and Republic Polytechnic.

Mrs. Koh spent nineteen years at the Singapore Ministry of Finance, which included postings at the Inland Revenue and Monetary Authority of Singapore. Her portfolio covered fiscal and taxation policy, corporate and financial regulation, international and multilateral finance policy in relation to the World Bank and Asian Development Bank. Mrs. Koh was appointed Deputy CEO, SingHealth, then a newly-created public healthcare cluster, from 2001-8, and concurrently Deputy CEO, Singapore General Hospital, from 2003. In the Education sector, other than Board-level experience.

Mrs. Koh has worked on the planning and successful start-up of two medical schools, and a k-12 international school in Singapore. After many years of operational experience in healthcare and education, Mrs. Koh pivoted into private equity and was Executive Director/CEO at IP Investment Management Singapore, an MAS-regulated alternative real estate fund manager from 2016-18.

Mrs. Koh has a BA (Hons) Economics from University of Cambridge and a Masters in Public Administration / International Tax Program (Certificate) from Harvard University. She was a Singapore President’s Scholar and Overseas Merit Scholar, and was awarded a Medal of Commendation by the National Trade Union Congress in 2008.

Mr. Marc Feliciano

Chairman, Non-Executive Director and Nominating and Remuneration Committee Member

Mr. Feliciano is the Global Head of Real Estate, Private Markets at Manulife Investment Management. In his role, Mr. Feliciano is responsible for developing and implementing the strategy and increasing the firm’s capabilities in this area on behalf of clients, including Manulife’s General Account. This includes overseeing all aspects of the real estate business, including portfolio management, investments, asset management, development of new products and the integration of sustainability into both investments and operations.

Prior to joining Manulife, Mr. Feliciano was the Chief Investment Officer (CIO) of Real Estate, Americas, and the Head of Portfolio and Asset Management for the RREEF Real Estate Americas business. He was also Head of the Americas Debt Investments Group. Mr. Feliciano was also a member of the Americas Leadership Committee and Global Investment Committee. He served as Chairman of the Americas Real Estate Investment Committee, which governs both equity and debt investments and portfolios, and serves on the Americas Real Estate Management Committee. As Americas CIO, he worked with portfolio managers in developing specific portfolio strategy for each account or fund as part of the annual investment plan process.

He also was a board member of RREEF Property Trust, a non-traded REIT. Prior to assuming this position, he served as Global Head of Risk and Performance Analysis, responsible for the development of allocation, risk and performance tools. In this role, he was a member of the Global CIO Group working closely with the Global and regional CIOs, and the research team to formulate the global and regional house views and strategy, and to develop the resulting House Portfolio for each region. While with RREEF Real Estate, he led debt restructurings across several accounts and funds in conjunction with the Americas portfolio management, asset management and capital markets teams. Mr. Feliciano also worked in the private and public real estate industries while at Morgan Stanley, Heitman/PRA Securities Advisors and INVESCO Realty Advisors.

He received undergraduate and graduate degrees in accounting with a concentration in finance from the University of Texas at Austin.

Professor Francis Koh Cher Chiew

Independent Non-Executive Director, Lead Independent Director, Audit and Risk Committee Member and Nominating and Remuneration Committee Member

Professor Francis Koh is Emeritus Professor of Finance (Practice) in the Lee Kong Chian School of Business, at the Singapore Management University (SMU). From 2002 to 2020, he taught at SMU, where he held various academic and administrative appointment. He was the Founding Director of the MSc in Wealth Management Programme at SMU from 2004 to 2019, Vice-Provost (Special Projects) from 2012 to 2017 and Inaugural Mapletree Professor of Real Estate from 2017 to 2019. From July 2017 to June 2020, he was also appointed Special Advisor, Office of the President, to oversee the Office of Investments, which manages the university’s endowment funds.

Prior to joining SMU in 2002, he was a tenured faculty at the National University of Singapore (NUS). While at NUS, he held several administrative positions, including Vice-Dean, Faculty of Business Administration and Director, Financial Management Program for Executives.

Between 1994 and 2002, Professor Koh was employed by the Government of Singapore Investment Corporation (GIC). He was involved in private equity investment projects in various countries in the region, including China, Thailand, Indonesia, and Malaysia. He was also involved in many corporate training and development initiatives at GIC.

Professor Koh has also been active in corporate consulting, executive development and public service. He is an Independent Non-Executive Director of China Taiping Insurance Pte Ltd in Singapore, and was a Member of the Board of Governors at the Singapore College of Insurance. He was appointed by Monetary Authority of Singapore (MAS) to the Financial Advisers Industry Review (FAIR) Panel in 2012 and by the Ministry of Law to the Advisory Panel on Money Lending in 2014. Organizations he had consulted for include Bank of Singapore, Citibank, GIC, IBM, IBF, Monetary Authority of Singapore, IMAS, Maybank, OCBC Bank, Singapore Airlines and Standard Chartered Bank.

He has published in numerous academic journals. His academic articles have appeared in the Journal of Financial Economics, Journal of Business Finance & Accounting, Journal of Business Venturing, Asia-Pacific Journal of Management and Singapore Economic Review. He has written book chapters and presented papers at international conferences, including meetings of the American Finance Association, Asia-Pacific Finance Association and Academy of International Business.

In 2012, Professor Koh was awarded an Honorary Doctorate (honoris causa) in Economics by the University of St Gallen, Switzerland. In 2013, he was conferred the Public Administration Medal (Silver) Award by the Singapore Government. In 2015, he received a special award for 20 years of service from the Ministry of Education. In 2016, he received the Lifetime Achievement Award from WealthBriefingAsia for his contributions to the wealth management industry. In 2020, he received the Distinguished Educator Award from SMU.

Professor Koh obtained the degree of BBA (Hons) from the University of Singapore, MBA from the University of British Columbia, and Ph.D from University of New South Wales. He is a member of the Institute of Chartered Public Accountant of Singapore and a Fellow of the Chartered Institute of Management Accountants (UK).

Ms. Veronica McCann

Independent Non-Executive Director and Audit and Risk Committee Chairman

Ms. McCann is a senior financial executive with over twenty three years' experience in the finance sector of the Asia Pacific Region.

Having a track record of leading organisational change and managing complex financial and regulatory risks during periods of rapid expansion and restructuring, Ms. McCann was CFO Asia and Deputy Chief Executive, Singapore up to 2015 at Commerzbank AG, the second largest credit institution in Germany and one of Europe's major banks. She started with Commerzbank in 2006 where she was mandated to build and develop strong independent Finance, HR and Legal/Compliance functions. Ms. McCann then transitioned to the Head of Finance & HR for Asia Pacific in 2008 and transitioned to the CFO role in 2009.

Prior to joining Commerzbank, Ms. McCann was at Canadian Imperial Bank of Commerce ("CIBC") in various roles from 1989 to 2006, including Head of Management Accounting, Europe. In 1992 Ms. McCann transferred to the CIBC Singapore office where she successfully led the finance function and obtained the CFO Asia appointment in 1993. In 1994 she was appointed Deputy Chief Executive of Singapore Branch. Between 1997 and 1998 she led the regional cross functional team to resize the Asia region. Ms. McCann commenced her career in the financial services sector with UBAF UK as an Assistant Chief Accountant.

Ms. McCann is a Fellow of the Institute of Management Accountants, a member of the Chartered Global Management Accountants and a Member of the Singapore Institute of Directors. She also served as the Treasurer of the British Chamber of Commerce Singapore from 2015 to 2018.

Dr. Choo Kian Koon

Independent Non-Executive Director and Nominating and Remuneration Committee Chairman

Dr. Choo has over 35 years of experience in the real estate industry including research, consulting, valuation, property management, leasing, development planning and investment appraisal in both the private and public sectors. His contributions to Singapore's urban development and real estate market over the years include being on the inaugural International Advisory Panel (IAP) for the development of the cutting edge one north project at Buona Vista, and serving as the Deputy Chairman of the Land Working Group of the Economic Review Committee (ERC) which sanctioned the creation of REITs and development of the New Downtown and Marina Bay Financial Centre. He has also served on the boards of JTC Corporation under the Ministry of Trade and Industry, Singapore Land Authority (SLA) under the Ministry of Law, the Valuation Review Board (VRB) under the Ministry of Finance, and NTUC Choice Homes under the National Trade Union Congress.

Since 2013, Dr. Choo has been the Chairman of VestAsiaGroup, a Singapore-based real estate advisory. He is also an Adjunct Associate Professor at the Department of Real Estate, National University of Singapore (NUS) and serves as an Independent Non-Executive Director on the board of SGX-listed Pan Hong Property Group Limited, a developer operating in China's second and third tier cities. Dr. Choo previously also served as an Independent Non-Executive Director on the board of Ascendas Hospitality Trust, a pan-Asian REIT and business trust active in the hotel and serviced apartment sectors.

Between 2009 and 2011, Dr. Choo served as the first CEO of the Real Estate Developers' Association of Singapore (REDAS) where he created the NUS-REDAS Real Estate Sentiment Index (RESI) for Singapore and established the NUS-REDAS executive courses in real estate development enterprise, and real estate development law. Before that, Dr. Choo was an independent consultant to Surbana Technologies in large-scale overseas township and tourism developments and strategic city management projects, as well as an expert trainer to private bankers in real estate and REITs at the Wealth Management Institute (WMI) of the Temasek Management Services Group.

In early 2002, Dr. Choo was appointed to the CapitaLand Group as its Senior Vice President, Research and Direct Investment, and was in the core team that supervised the successful launch of the first REIT in Singapore – the retail-based CapitaMall Trust (CMT). Apart from serving as a director on CMT's inaugural board, Dr. Choo was also instrumental in the IPO of the Group's second REIT, the office-based CapitaCommercial Trust (CCT), and held various portfolios such as SVP, Corporate Development, and country head, Malaysia.

Prior to joining CapitaLand, between 1995 and 2001, Dr. Choo was a senior partner and the National Director and Head of Research and Consultancy at Jones Lang LaSalle (JLL) Singapore. He was JLL Asia Pacific regional head of research and Global Research Committee member and had advised numerous international financial institutions and institutional investors as well as sovereign wealth funds such as the GIC and Abu Dhabi Investment Authority. Before JLL, Dr. Choo was with Richard Ellis Property Consultants (1993-1995), the School of Building & Estate Management, NUS (1981-1993), and Lands and Estate Division, Ministry of Defence (1979-1981) where he held several senior positions.

A Commonwealth Scholar, Dr. Choo obtained an M.Phil in Environmental Planning from the University of Nottingham (1979) after graduating from the University of Singapore in Estate Management (1974). Dr. Choo holds a Ph.D in Urban Planning from the University of Washington with a Certificate of Achievement in Urban Design (1988) and is a member of the Tau Sigma Delta Honors Society in Architecture and Allied Arts, USA. He is a Fellow of the Singapore Institute of Surveyors and Valuers(SISV) and an Affiliate Member of the Singapore Institute of Planners (SIP).

Mrs. Karen Tay Koh

Independent Non-Executive Director, Audit and Risk Committee Member and Nominating and Remuneration Committee Member

Mrs. Koh is a Board Director with extensive experience in both public and private sectors, who has supervised, led or advised organisations spanning finance, healthcare, education, and private equity. She has expertise in executing business-building entrepreneurial initiatives across companies in various stages in their life cycle, from start-ups to dominant industry incumbents.

Mrs. Koh is an Independent Non-Executive Director at SGX-listed Banyan Tree Holdings, HSBC Bank Singapore Limited, BC Platforms AG and The Red Pencil Singapore. She is a member of the Advisory Board of the Centre for Emerging Markets, D’Amore-Mckim College of Business, Northeastern University US, and was a member of Northeastern’s Corporation from 2011-2018. Mrs. Koh’s past board experience include Falck (Denmark), Singapore Deposit Insurance Corporation, Singapore Economic Development Board Investments Pte Ltd and Republic Polytechnic.

Mrs. Koh spent nineteen years at the Singapore Ministry of Finance, which included postings at the Inland Revenue and Monetary Authority of Singapore. Her portfolio covered fiscal and taxation policy, corporate and financial regulation, international and multilateral finance policy in relation to the World Bank and Asian Development Bank. Mrs. Koh was appointed Deputy CEO, SingHealth, then a newly-created public healthcare cluster, from 2001-8, and concurrently Deputy CEO, Singapore General Hospital, from 2003. In the Education sector, other than Board-level experience.

Mrs. Koh has worked on the planning and successful start-up of two medical schools, and a k-12 international school in Singapore. After many years of operational experience in healthcare and education, Mrs. Koh pivoted into private equity and was Executive Director/CEO at IP Investment Management Singapore, an MAS-regulated alternative real estate fund manager from 2016-18.

Mrs. Koh has a BA (Hons) Economics from University of Cambridge and a Masters in Public Administration / International Tax Program (Certificate) from Harvard University. She was a Singapore President’s Scholar and Overseas Merit Scholar, and was awarded a Medal of Commendation by the National Trade Union Congress in 2008.

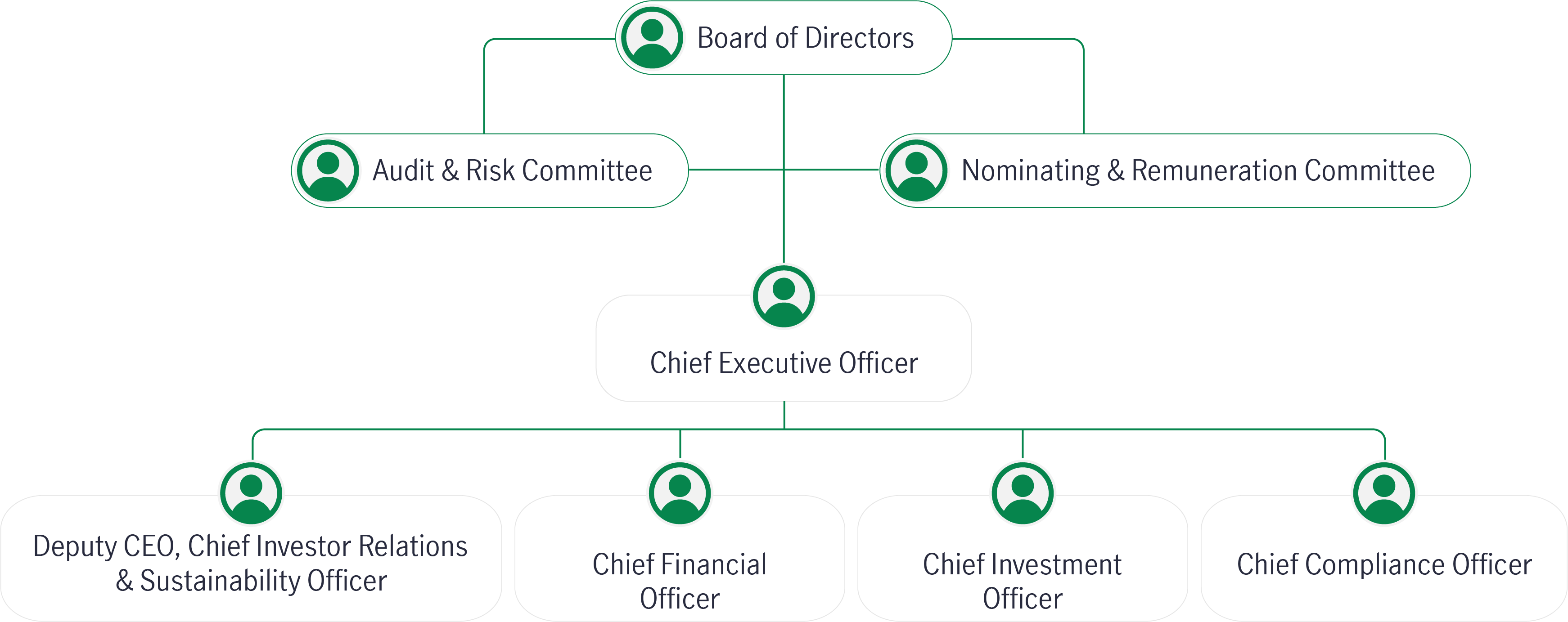

Management Team

The Manager, Manulife US Real Estate Management Pte. Ltd., was incorporated in Singapore under the Companies Act on 2 February 2015.

The Manager is indirectly wholly-owned by the Sponsor. The Manager has general powers of management over the assets of Manulife US REIT. The Manager's main responsibility is to manage Manulife US REIT's assets and liabilities for the benefit of Unitholders.

The Manager will set the strategic direction of Manulife US REIT and give recommendations to the Trustee on the acquisition, divestment, development and/or enhancement of assets of Manulife US REIT in accordance with its stated investment strategy.

To the extent activities of the Manager, including under the Management Agreement, would otherwise be required to be performed within the United States (and are not otherwise to be performed by the U.S. Asset Manager), those activities will be delegated to S-REIT Manager US Corp., a wholly-owned subsidiary of the Manager incorporated in the United States.

The Manager has been issued a Capital Markets Services to the Securities and Futures Act on 2 July 2015 and is regulated by the Monetary Authority of Singapore.

Mr. Tripp Gantt

Chief Executive Officer

Follow on LinkedIn

Mr. Tripp Gantt is the Chief Executive Officer (CEO) of the Manager. He works with the Board to determine the strategy for MUST as well as with other members of the management team to execute MUST’s investment strategy. Mr Gantt is also responsible for the overall day-to-day management and operations of MUST, working with the Manager’s investment, asset management, financial and legal and compliance personnel in meeting the strategic, investment and operational objectives of MUST.

Mr. Gantt is a real estate investment professional with over 25 years of experience. Prior to joining the Manager, Mr. Gantt was Assistant Senior Investment Officer at the Washington State Investment Board (WSIB), a leading US pension fund with an AUM of approximately $25 billion in real estate. In his role at WSIB Mr. Gantt devised and implemented investment strategies for its international real estate portfolio.

During his 16 year tenure at WSIB, Mr. Gantt managed the origination and execution of real estate investments in operating companies and strategic partnerships in the US and globally, including industrial, logistics, multifamily, retail, office, hospitality and self-storage. He was also responsible for strategic initiatives in risk management and real estate technology, as well as oversight of ESG and sustainability matters.

Prior to joining WSIB in 2005, Mr. Gantt's experience included roles as an independent real estate consultant, an Associate Project Manager with Heartland LLC, and a Land Acquisitions Manager at Scatter Creek Holdings. He began his real estate career at PGP Valuation as a Commercial Real Estate Analyst & Appraiser.

Mr. Gantt holds a Bachelor's degree in Geography and Urban Studies from Georgia State University.

Ms. Caroline Fong

Deputy CEO, Chief Investor Relations and Sustainability Officer

Follow on LinkedIn

Ms. Caroline Fong is the Deputy Chief Executive Officer, Chief Investor Relations and Sustainability Officer at MUST. She works with the CEO and his senior leadership team to help formulate and execute MUST’s investment strategies, including working with the investment, asset management, financial and legal/compliance personnel in meeting the strategic investment objectives of MUST. She focuses on Capital Markets, exploring strategic opportunities, alternative capital sources and business development. She is also responsible for sustainability, Investor Relations (IR), corporate and digital communications and the equity capital markets requirements for MUST.

Ms. Fong has close to 20 years of experience in IR, capital markets, real estate and regulations. Prior to joining the Manager, Ms. Fong was Associate Director, IR and Corporate Finance in Temasek Holdings and Head of IR and Corporate Communications in ESR-LOGOS REIT. At ESR-LOGOS REIT, Ms. Fong helped profiled the REIT to be the best performing industrial REIT and second best performing SREIT in 2013.

In addition, Ms. Fong was formerly Head of IR for CapitaLand Mall Asia, where she was responsible for the equity story of the company’s retail businesses and its three REITs. She was also part of the core team who successfully dual-listed the firm in Hong Kong. Early in her career, Ms. Fong was Associate Director, Listings, at the Singapore Exchange, where she advised companies on corporate governance and the regulatory framework for public-listed companies in Singapore.

Ms. Fong holds a Master’s in Finance and Investment from the Nottingham University Business School, U.K. and a Bachelor of Science (Honours) in Banking and Finance from the University of London, U.K.

Mr. Robert Wong

Chief Financial Officer

Follow on LinkedIn

Mr. Robert Wong is the Chief Financial Officer of the Manager. He is responsible for finance, capital management, treasury and accounting operations for MUST. He is also responsible for managing the debt and capital market programmes.

Mr. Wong has over 20 years of experience in the finance and accounting professions, mainly in the real estate investment management industry.

Prior to his current appointment, he was Director, Finance and Operations at ARA LOGOS Logistics Trust. He was responsible for all aspects of financial and statutory reporting and compliance with SGX-ST and MAS, including financing and treasury activities, evaluating investment opportunities, risk management and compliance functions.

Before embarking on a career in the Singapore REIT sector, Mr. Wong was Senior Vice President with CBRE Global Investors and ING Real Estate from 2007 to 2012. Prior to that, he was based in Australia where he held various finance and accounting positions with Mirvac Funds Management, Colonial First State Property and Westpac Investment Property Limited.

Mr. Wong holds a Bachelor of Commerce from Murdoch University, Australia and is a Fellow of CPA Australia.

Mr. Patrick Browne

Chief Investment Officer

Follow on LinkedIn

Mr. Patrick Browne is the Chief Investment Officer of the Manager. He is responsible for the design and execution of the portfolio investment strategy, as well as overseeing the U.S. asset and property management functions.

Mr. Browne is a seasoned real estate professional with more than 15 years of experience. Before joining the Manager, he was VP of Global Direct Real Estate at Swiss Re where he was responsible for designing, executing and overseeing direct real estate investment strategies/mandates for the company’s multi-billion dollar real estate portfolio including a U.S. portfolio of office, industrial and multifamily properties as well as strategies and portfolios in Australia, the UK and parts of Europe.

Prior to Swiss Re Mr. Browne performed acquisitions, asset management and leasing work for Broadway Partners, as well as tenures at Cushman & Wakefield, Republic Investment Company and as a co-founder of a real estate technology start-up.

Through his career to date Mr. Browne has worked across diverse real estate capacities, been involved in all aspects of vertically integrated real estate platforms and is familiar with the requirements of a wide variety of investors, market commentators and stakeholders.

Mr. Browne received a Master of Science in Real Estate from New York University and a Bachelor of Arts from the University of Dayton.

Ms. Daphne Chua

Chief Compliance Officer

Follow on LinkedIn

Ms. Daphne Chua is the Chief Compliance Officer. As the key liaison with the regulators, she is responsible for overseeing and managing regulatory filings on behalf of MUST and assisting MUST in complying with the applicable provisions of the Securities and Futures Act (SFA) and all other relevant legislations.

Ms. Chua has over 20 years of experience in the field of compliance for a variety of global financial institutions with operations in Singapore. She has developed compliance and related policies and procedures by implementing local and international industry best practices. In addition, Ms. Chua has worked closely with various boards of directors and senior management, both in Singapore and internationally, in ensuring compliance with relevant laws and regulations, internal policies and procedures.

Prior to joining the Manager in 2015, Ms. Chua held a number of compliance positions including those for J.P. Morgan Asset Management, Manulife Asset Management, Credit Suisse Private Banking and Morgan Stanley in Singapore.

Ms. Chua holds a Bachelor of Accountancy (with a Minor in Banking & Finance) (Honours) from Nanyang Technology University, Singapore.

Mr. Choong Chia Yee

Head of Finance

Follow on LinkedIn

Mr Choong Chia Yee is the Head of Finance. He is responsible for financial and management reporting, as well as the day-to-day running of finance operations.

Mr Choong has over 25 years of experience in accounting, finance, strategic planning, budgeting, tax, initial public offering, audit, regulatory reporting and compliance. Prior to joining the Manager in November 2016, Mr Choong was Vice President, Finance at Mapletree Logistics Trust and he held several positions in CapitaLand Mall Asia. He has extensive experience of corporate entities that have widespread international operations.

Mr Choong holds a professional qualification from the Chartered Institute of Management Accountants, U.K. He also holds the designations of Chartered Global Management Accountant, Chartered Accountant of Singapore and Chartered Accountant of Malaysia.

Mr. Tripp Gantt

Chief Executive Officer

Follow on LinkedIn

Mr. Tripp Gantt is the Chief Executive Officer (CEO) of the Manager. He works with the Board to determine the strategy for MUST as well as with other members of the management team to execute MUST’s investment strategy. Mr Gantt is also responsible for the overall day-to-day management and operations of MUST, working with the Manager’s investment, asset management, financial and legal and compliance personnel in meeting the strategic, investment and operational objectives of MUST.

Mr. Gantt is a real estate investment professional with over 25 years of experience. Prior to joining the Manager, Mr. Gantt was Assistant Senior Investment Officer at the Washington State Investment Board (WSIB), a leading US pension fund with an AUM of approximately $25 billion in real estate. In his role at WSIB Mr. Gantt devised and implemented investment strategies for its international real estate portfolio.

During his 16 year tenure at WSIB, Mr. Gantt managed the origination and execution of real estate investments in operating companies and strategic partnerships in the US and globally, including industrial, logistics, multifamily, retail, office, hospitality and self-storage. He was also responsible for strategic initiatives in risk management and real estate technology, as well as oversight of ESG and sustainability matters.

Prior to joining WSIB in 2005, Mr. Gantt's experience included roles as an independent real estate consultant, an Associate Project Manager with Heartland LLC, and a Land Acquisitions Manager at Scatter Creek Holdings. He began his real estate career at PGP Valuation as a Commercial Real Estate Analyst & Appraiser.

Mr. Gantt holds a Bachelor's degree in Geography and Urban Studies from Georgia State University.

Ms. Caroline Fong

Deputy CEO, Chief Investor Relations and Sustainability Officer

Follow on LinkedIn

Ms. Caroline Fong is the Deputy Chief Executive Officer, Chief Investor Relations and Sustainability Officer at MUST. She works with the CEO and his senior leadership team to help formulate and execute MUST’s investment strategies, including working with the investment, asset management, financial and legal/compliance personnel in meeting the strategic investment objectives of MUST. She focuses on Capital Markets, exploring strategic opportunities, alternative capital sources and business development. She is also responsible for sustainability, Investor Relations (IR), corporate and digital communications and the equity capital markets requirements for MUST.

Ms. Fong has close to 20 years of experience in IR, capital markets, real estate and regulations. Prior to joining the Manager, Ms. Fong was Associate Director, IR and Corporate Finance in Temasek Holdings and Head of IR and Corporate Communications in ESR-LOGOS REIT. At ESR-LOGOS REIT, Ms. Fong helped profiled the REIT to be the best performing industrial REIT and second best performing SREIT in 2013.

In addition, Ms. Fong was formerly Head of IR for CapitaLand Mall Asia, where she was responsible for the equity story of the company’s retail businesses and its three REITs. She was also part of the core team who successfully dual-listed the firm in Hong Kong. Early in her career, Ms. Fong was Associate Director, Listings, at the Singapore Exchange, where she advised companies on corporate governance and the regulatory framework for public-listed companies in Singapore.

Ms. Fong holds a Master’s in Finance and Investment from the Nottingham University Business School, U.K. and a Bachelor of Science (Honours) in Banking and Finance from the University of London, U.K.

Mr. Robert Wong

Chief Financial Officer

Follow on LinkedIn

Mr. Robert Wong is the Chief Financial Officer of the Manager. He is responsible for finance, capital management, treasury and accounting operations for MUST. He is also responsible for managing the debt and capital market programmes.

Mr. Wong has over 20 years of experience in the finance and accounting professions, mainly in the real estate investment management industry.

Prior to his current appointment, he was Director, Finance and Operations at ARA LOGOS Logistics Trust. He was responsible for all aspects of financial and statutory reporting and compliance with SGX-ST and MAS, including financing and treasury activities, evaluating investment opportunities, risk management and compliance functions.

Before embarking on a career in the Singapore REIT sector, Mr. Wong was Senior Vice President with CBRE Global Investors and ING Real Estate from 2007 to 2012. Prior to that, he was based in Australia where he held various finance and accounting positions with Mirvac Funds Management, Colonial First State Property and Westpac Investment Property Limited.

Mr. Wong holds a Bachelor of Commerce from Murdoch University, Australia and is a Fellow of CPA Australia.

Mr. Patrick Browne

Chief Investment Officer

Follow on LinkedIn

Mr. Patrick Browne is the Chief Investment Officer of the Manager. He is responsible for the design and execution of the portfolio investment strategy, as well as overseeing the U.S. asset and property management functions.

Mr. Browne is a seasoned real estate professional with more than 15 years of experience. Before joining the Manager, he was VP of Global Direct Real Estate at Swiss Re where he was responsible for designing, executing and overseeing direct real estate investment strategies/mandates for the company’s multi-billion dollar real estate portfolio including a U.S. portfolio of office, industrial and multifamily properties as well as strategies and portfolios in Australia, the UK and parts of Europe.

Prior to Swiss Re Mr. Browne performed acquisitions, asset management and leasing work for Broadway Partners, as well as tenures at Cushman & Wakefield, Republic Investment Company and as a co-founder of a real estate technology start-up.

Through his career to date Mr. Browne has worked across diverse real estate capacities, been involved in all aspects of vertically integrated real estate platforms and is familiar with the requirements of a wide variety of investors, market commentators and stakeholders.

Mr. Browne received a Master of Science in Real Estate from New York University and a Bachelor of Arts from the University of Dayton.

Ms. Daphne Chua

Chief Compliance Officer

Follow on LinkedIn

Ms. Daphne Chua is the Chief Compliance Officer. As the key liaison with the regulators, she is responsible for overseeing and managing regulatory filings on behalf of MUST and assisting MUST in complying with the applicable provisions of the Securities and Futures Act (SFA) and all other relevant legislations.

Ms. Chua has over 20 years of experience in the field of compliance for a variety of global financial institutions with operations in Singapore. She has developed compliance and related policies and procedures by implementing local and international industry best practices. In addition, Ms. Chua has worked closely with various boards of directors and senior management, both in Singapore and internationally, in ensuring compliance with relevant laws and regulations, internal policies and procedures.

Prior to joining the Manager in 2015, Ms. Chua held a number of compliance positions including those for J.P. Morgan Asset Management, Manulife Asset Management, Credit Suisse Private Banking and Morgan Stanley in Singapore.

Ms. Chua holds a Bachelor of Accountancy (with a Minor in Banking & Finance) (Honours) from Nanyang Technology University, Singapore.

Mr. Choong Chia Yee

Head of Finance

Follow on LinkedIn

Mr Choong Chia Yee is the Head of Finance. He is responsible for financial and management reporting, as well as the day-to-day running of finance operations.

Mr Choong has over 25 years of experience in accounting, finance, strategic planning, budgeting, tax, initial public offering, audit, regulatory reporting and compliance. Prior to joining the Manager in November 2016, Mr Choong was Vice President, Finance at Mapletree Logistics Trust and he held several positions in CapitaLand Mall Asia. He has extensive experience of corporate entities that have widespread international operations.

Mr Choong holds a professional qualification from the Chartered Institute of Management Accountants, U.K. He also holds the designations of Chartered Global Management Accountant, Chartered Accountant of Singapore and Chartered Accountant of Malaysia.