2 August 2022

Are REITs just for retirees?

In our previous article “What are REITs?”, we shared about the types of asset classes and geographical breakdown of REITs listed in Singapore. In this next article of our #MUSTExplains series, where we share about REITs, the U.S. economy and the office sector, we discuss the reasons why people invest in REITs, and some risks to consider.

REITs may not be as exciting as tech stocks and cryptocurrencies, but here are four popular reasons why investors hold them :

- Cost-effective way to invest in real estate: Direct property investment is more capital intensive and illiquid, while investing in REITs is more affordable and enables investors to grow their capital in a shorter period of time. It is also more liquid as investors can buy or sell units in a listed REIT on the stock exchange. Real estate is also known to be a hedge against inflation as their prices/rentals increase with inflation.

- Total return investments: REITs typically provide high dividends and have the potential for moderate, long-term capital appreciation. Long-term total returns of REITs tend to be similar to those of value stocks and exceed the returns of banks’ fixed deposits and lower risk bonds.

- Stable income stream: As REITs are required to distribute a minimum 90% of their income, their distribution yields tend to be higher than stocks or fixed deposits. SREITs average ~6% in dividend yields and have continued to generate substantial, stable yields through a variety of market conditions. This is why they are preferred by retirement savers and retirees who seek certainty and stability in their returns.

- Diversification: The returns of REITs typically have a lower correlation with the returns of other equities and fixed-income investments. Investing in REITs thus helps to reduce a portfolio’s overall volatility and improve its returns for a given level of risk.

As with all investments, here are some possible risks when investing in REITs:

- Market risk: REITs are traded on the stock exchange and their prices are subject to supply and demand conditions. Their prices generally reflect investors’ confidence in the economy, property market and interest rate outlook, among other factors.

- Income risk: Many factors can affect a REIT’s rental income – for instance, when tenants renew at lower rentals or vacate their space. Therefore, look for stable occupancies, positive rental reversions, and contractual lock-ins of rental rates and other clauses in a REIT’s tenancy agreements to ensure income stability.

- Leverage risk: If a REIT’s leverage limit approaches too close to the regulatory limit of 50%, it will limit the REIT’s financial flexibility to raise more capital through debt. Furthermore, additional expenses of borrowing such as interest payments and fees incurred in connection with the borrowing will reduce the money available for distribution to unitholders.

- Refinancing risk: REITs may face higher refinancing costs when loans are due for renewal, or they may be unable to secure refinancing and resort to selling off properties if these assets are mortgaged under the loan. These risks could affect the unit price and income distribution of a REIT.

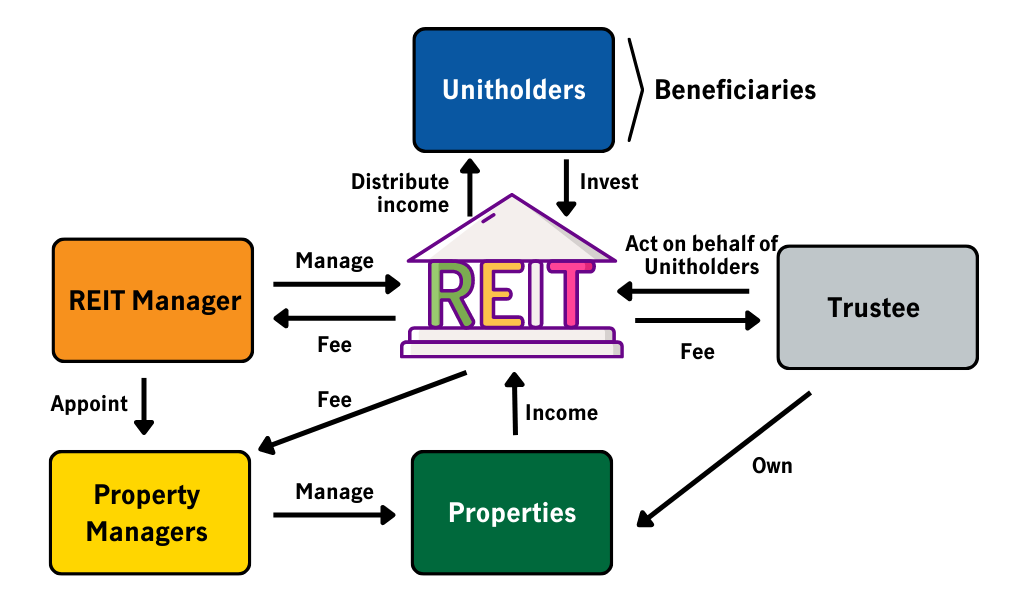

REIT Structure

Here’s a diagram of a typical REIT structure.

Besides the REIT vehicle, there are three external parties working in relation to it. All three parties are paid fees for their services.They are the:

- i.Trustee - Responsible for the ownership and safe custody of the REIT’s assets, they act on behalf of unitholders to ensure the REIT Manager complies with the law and performs its duties as laid out in the Trust Deed.

- ii.REIT Manager – It manages the REIT in the best interests of unitholders, which includes setting the REIT’s strategic direction, managing assets and liabilities, as well as making recommendations to the Trustee on the acquisition, divestment and enhancement of assets according to the REIT’s investment mandate.

- iii.Property Manager – It manages the day-to-day operations and maintenance at the respective properties.

Most SREITs also have Sponsors - typically but not necessarily property developers which inject properties into the REIT during listing. Many Sponsors continue to support the growth of the REITs by offering them rights to acquire a future pipeline of properties. Sponsors are often also major unitholders of the REITs they sponsor.

In the next article, we will discuss how to start investing in REITs and stocks. Stay tuned!

Sources:

- NAREIT, "Why invest in Real Estate Investment Trusts (REITs)?"

- REITAS.sg, “Overview of the S-REITs Industry”

- MoneySense.gov.sg, “Understanding real estate investment trusts (REITS)”, 29 Oct 2018

- “REITs to Riches – Everything You Need to Know about Investing Profitably in REITs” by Tam Ging Wien

Disclaimer: This article is for informational purposes only and shall not be construed as financial advice or an offer, invitation or solicitation of any offer to purchase or subscribe for any securities of Manulife US REIT in Singapore or any other jurisdiction nor should it or any part of it form the basis of, or be relied upon in connection with, any contract or commitment whatsoever. You should always do your due diligence and seek professional advice before making any investment decisions. None of the information presented are intended to form the basis for any investment decision, and no specific recommendations are intended.